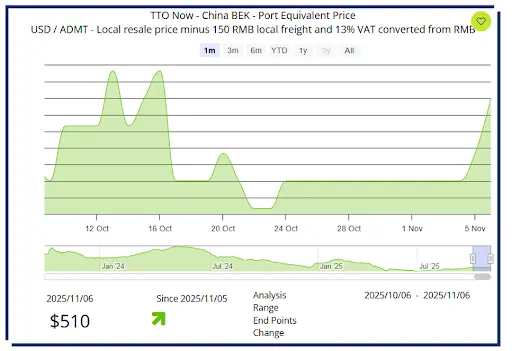

Following a decline in market pulp prices, buyers and traders in China have restocked hardwood pulp over the last months. This restocking activity, while not sufficient to enable producers to fully implement the announced price increase, helped stabilize prices, keeping them unchanged during this period. For instance, hardwood pulp prices in China remained steady at approximately $510 per ton in the last 30 days (TTO Now China- BEK), despite efforts to raise prices.

The dynamics of softwood pulp are different. Chinese pulp producers have moved production from hardwood to softwood, resulting in an increase in local softwood pulp availability. This shift has led to an oversupply in the domestic market, exerting downward pressure on prices. As a result, production shutdowns in Europe and North America have become more frequent, signaling that current price levels are unsustainable over the long term (registered users, see TTO BMA Downtime Report for details).

Meanwhile, recent trade tensions have further complicated the global market landscape. The ongoing trade war has introduced uncertainty for major market generators and has prompted companies to redirect exports to secondary markets. For example, tissue exports that would traditionally flow from Brazil, China, and Indonesia to the United States have instead shifted to Europe. This reallocation has impacted local market dynamics.

For additional information or to subscribe to our services, please contact info@ttobma.com.