When people think about paper production in Wisconsin, they normally think about one of our large pulp and paper mills. Pulp and paper mills use vast quantities of pulpwood from Wisconsin’s forests to produce a variety of bulk paper products. Without a doubt, these mills play a crucial role in managing our forests by providing markets for pulpwood from our forests and chip residues from Wisconsin sawmills. There are a large number of paper converters in Wisconsin that often go overlooked. Paper converters use the bulk paper products produced at primary pulp and paper mills and add value to those products. For this reason, we call them secondary producers. Primary producers, like pulp mills, get their raw materials from the forest. Secondary producers, like paper converters, get their raw materials from the primary paper producers.

In 2022, there were more than 145 paper converters operating in Wisconsin. Paper converters play an important role in Wisconsin’s larger paper industry by adding value to the primary products produced at our paper mills. Simply put, a paper converter takes a base paper and manufactures it into a value-added paper product. For example, a large roll of kraft paper could be printed, coated, and sheeted into sandwich wrappers for a specific client. Classes of paper converters operating in Wisconsin include corrugated and solid fiber box manufacturing, folding paperboard box manufacturing, other paperboard container manufacturing, paper bag and coated and treated paper manufacturing, stationery product manufacturing, and sanitary paper product manufacturing to name a few.

Wisconsin’s pulp and paper and paper converting industries have a large impact on our economy. Overall, the forest industry generates $23.4 billion in output annually and employs more than 50,000 people. This includes forestry, logging, solid wood, and paper. Paper makes up roughly 75% of this impact. Our primary paper producers generate $6.5 billion in output annually and employs 8,459 people. Our secondary paper converters generate $10.9 billion in output annually and employs 19,265 people. The secondary paper converting industry has seen a 16% growth since 2018.

In the fall of 2022, the Wisconsin Paper Council in conjunction with the University of Wisconsin conducted a survey of Wisconsin’s paper converting industry. The survey reached 142 companies with 48 responding for a 33% response rate. This article reports the findings of this study.

Paper Stock Origin

We asked the responding companies to indicate what type of paper stock they purchased for conversion. Table 1 shows the responses with cartonboard, containerboard, and specialty grades with the highest responses. Several respondents reported contract/toll conversion, so they do not take ownership of the paper stock.

Table 1: Raw Material Paper Stock Categories Purchased

| Raw Material Paper Stock | Respondent Percentage |

| cartonboard | 57.1% |

| containerboard | 54.8% |

| newsprint | 7.5% |

| non-papers | 27.5% |

| packaging papers | 22.5% |

| printing or writing grades | 39.5% |

| specialty grades | 47.7% |

| tissue or towel grades | 17.5% |

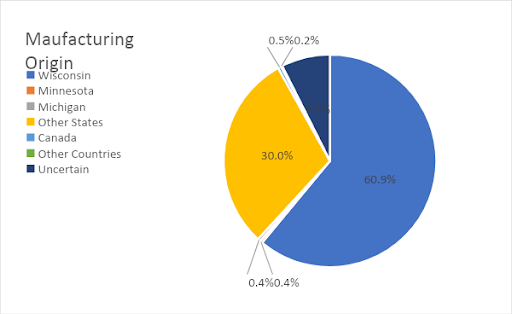

Do Wisconsin’s paper converters use paper manufactured by Wisconsin’s paper mills? Respondents were asked if their paper stock was manufactured in Wisconsin, Minnesota, Michigan, other state, or other country. This question is more complicated than it appears on its surface. About 19% of the study respondents buy 100% of their paper stock from Wisconsin paper mills. In contrast, only 2% of the respondents buy 100% of their paper stock from another state and none of the respondents buy 100% of their paper stock from another country. Figure 1 shows the manufacturing origin of paper stock used by Wisconsin’s paper converters based on the total volume respondents reported using. Wisconsin paper mills represent the bulk of the paper stock raw material with immediate neighboring states and Canada representing very little volume. Other states providing significant volume include Georgia, Indiana, Maine, and Ohio.

(percentages do not total to 100% due to rounding error)

Virgin vs. Recycled Fiber

The total volume of paper stock purchased by the respondents totaled 8,035,676 tons in 2021. Of this total, 12.5% of respondents stated their facility only used 100% virgin fiber in 2021. These companies were primarily box manufacturers. For those respondents that reported volumes of paper stock converted, virgin fiber constituted 38% of the total volume reported with pre- and post-consumer recycled fiber totaling 62% of fiber used (Figure 2).

Certification

Certification systems have played a role in the forest products industry for several decades. These include forestland certification, chain of custody certifications, and more. Forty percent of respondents stated their facility was chain of custody certified. Table 2 shows which certification systems were employed by the respondents with the Forest Stewardship Council and the Sustainable Forestry Initiative representing the bulk of the responses.

Table 2: Certification Participation.

| Certification System | % Participation |

| American Tree Farm System or ATFS | 0% |

| Forest Stewardship Council or FSC | 74% |

| Sustainable Forestry Initiative or SFI | 68% |

| Canadian Standards Assoc. Sustainable Forest Mgmt. System or CSA-SFM | 0% |

| Programme for the Endorsement of Forest Certification or PEFC | 11% |

| other certification | 0% |

The state of Wisconsin offers a group forestland certification in the Sustainable Forestry Initiative, American Tree Farm, and Forest Stewardship Council systems for forestland owners.

When asked if a similar group certification for paper converters would benefit their facility, 38% replied that it would be a benefit.

Labor

Finding labor (skilled or unskilled) has plagued all industries since the pandemic. Table 3 details employment numbers as well as open positions for responding companies. The data shows that participating companies were well represented across all employment size categories. Smaller companies tended to have more part-time employees. Only 16% of companies reported no open positions. Nearly 75% of responding companies reported between 1 and 19 open positions with 9% reporting more than 20 open positions.

Table 3: Employment Numbers and Open Positions.

| Employment Category | None | 1 to 4 | 5 to 19 | 20 to 99 | 100 or more |

| Full-time employees | 0% | 10.4% | 8.3% | 50.0% | 31.3% |

| Part-time employees | 32.6% | 39.5% | 23.3% | 4.7% | 0% |

| Open positions | 16.3% | 51.2% | 23.3% | 9.3% | 0% |

Business Climate

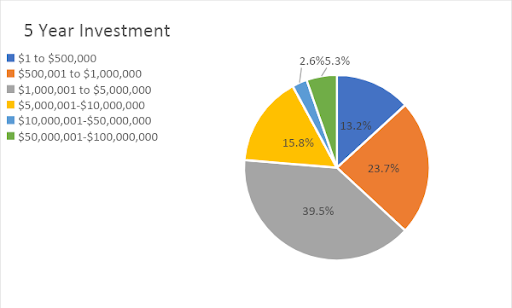

Many of the responding companies have operated in the paper industry for decades. The average company age of operations was 42 years with some operating for only 5 years and one respondent having been in operation for 130 years. Just over half of the respondents, 52%, said they plan to grow or expand their facility in the next five years with 81% planning on investing in new converting equipment. Investments range from hundreds of thousands to hundreds of millions of dollars as shown in Figure 3. The annual capital expenditures for paper converters in Wisconsin has averaged $400 million over the past 5 years.

Certification & Labeling/Regulatory/Logistics/Production/Workforce Challenges

and Workforce Challenges within the Converting Industry.

We asked a series of questions about the challenges within the converting industry. The major topics included certification and labeling, regulatory, logistics, production, and workforce challenges (Figure 4).

Certification & Labeling and Regulatory were two of the least challenging categories (Figure 4). The large dark blue bars shown in Figure 4 align with not at all challenging on our study scale. That does not mean there are no challenges in those categories as shown by the grey, yellow, and light blue bars. Given the diversity of companies within the paper converting industry, there is also a diversity of challenges depending upon what market segment each company operates within.

The Logistics category proved significantly more challenging for the respondents. Access to trucking, trucking or shipping costs, and reliable freight were challenges for most respondents (Figure 4).

The Production category showed significant variability across respondents (Figure 4). Finding paper stock has been problematic in recent months. One company stated, “We need paper. Our industry is $18 billion and growing and we do not have enough domestic supply of paper face or liner. Please help.”

Finally, the Workforce category showed challenges across all respondents. Hiring a quality workforce, retaining a quality workforce, and matching workforce hourly wage in competing industries were all problems (Figure 4). One company stated that finding employees was extremely difficult. Whatever profits they made go back to shipping and employees because of inflation.

Training

There are numerous opportunities for training within Wisconsin’s paper converting industry. All topics shown in Figure 5 show training needs by certain respondents. Topics such as advances in paper-based packaging and functional coatings and additives show significant interest by respondents. Diversity across the industry plays a role in training since not all companies have the same specialties.

Concluding Remarks

Paper converters are essential for sustainable forest management and the smooth functioning of wood and fiber markets that account for a sizable portion of Wisconsin’s economy. Keeping these businesses healthy will be important for the wood supply chain and the many rural economies it helps support.

The authors would like to thank the Wisconsin SFI Implementation Committee grant program for funding this project. We would also like to thank Wisconsin’s paper converters for responding to this study – Your time and efforts are appreciated!

Authors: Scott Bowe, University of Wisconsin-Madison; Paul Fowler, University of Wisconsin-Stevens Point; Julie Ballweg, USDA Forest Products Laboratory, and Stacey Johnson, Wisconsin Paper Council.